[#SNP_SPOTLIGHT] Maritime news update on February/2023 (Part 2)

20/02/2023

![[#SNP_SPOTLIGHT] Maritime news update on February/2023 (Part 2)](https://cdn.saigonnewport.com.vn/uploads/images/2023/02/20/website-thumbnail-2-63f31eff0f219.png)

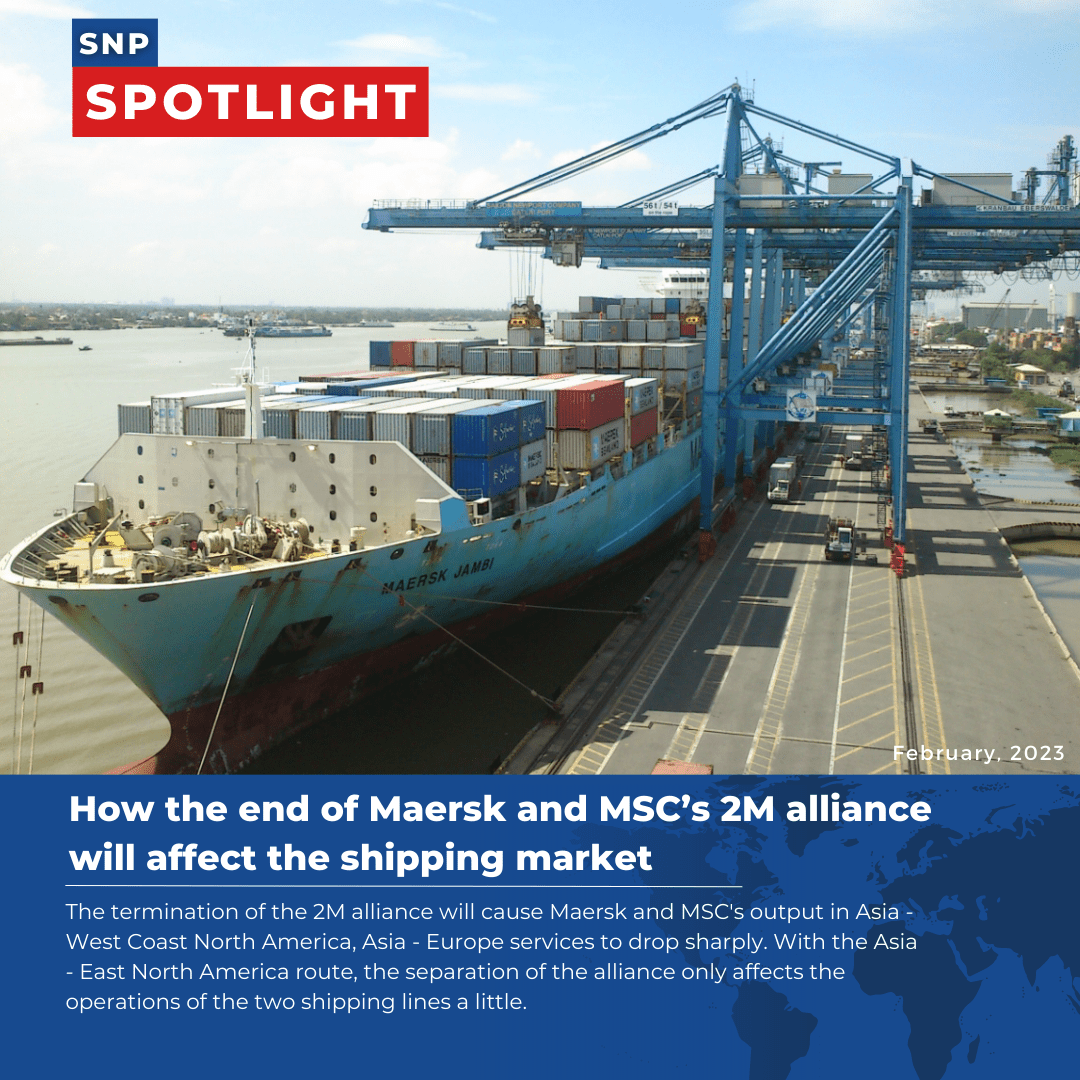

Experts say that the split could prompt capacity shifts and lower rates as competition for customers heats up.

The end of a shipping alliance between two of the world’s largest container lines could pave the way for more competition and lower rates in ocean shipping.

Maersk and MSC said last month that they would not continue their 2M alliance once it expires in 2025. The vessel-sharing agreement, which began in 2015 and propmpted a wave of consolidation in the industry, allowed the two companies to better manage capacity by pooling cargo.

Although the 2M alliance has drawn scrutiny from federal regulators over potential anticompetitiveness issues, the carriers say they decided to end their agreement as they pursue individual strategies. Maersk, for example, has invested heavily to expand beyond ocean shipping and become an end-to-end supply chain provider.

Experts say that the end of 2M could lead to capacity shifts and spark other carriers to rethink their alliances. Here’s what shippers can expect from the end of the world’s largest shipping alliance.

Breakup could impact rates, capacity

The end of 2M is likely to prompt some short-term changes to capacity and price.

The break up is expected to spark increased competition from ocean carriers and will have other companies rethinking their alliances, Lars Jensen, CEO and Partner at Vespucci Maritime, wrote in an email to Supply Chain Dive.

Increased competition could lead to lower rates. Once the alliance ends, shippers will have the choice between Maersk, MSC or another carrier — which could push shipping companies to fight over customers.

“In the short term (i.e. 2023) this will mean increased competitive pressure between the carriers which all else equal results in rates that are lower than they otherwise would have been,” Jensen said.

Those lower rates, however, could come at the expense of more volatile service and a higher number of blank sailings, he added.

MSC and Maersk’s split could also spark other carriers to rethink their alliances, which would further roil rates and capacity.

“Other global carriers will be looking at the changing landscape and consider whether their own current alliance memberships is the right thing for them in the long-term,” said Jensen.

Maersk and MSC’s separate paths

Breaking up 2M also means that Maersk will become a significantly smaller player in the ocean industry. A Sea-Intelligence report found that post-alliance, Maersk will have an operating capacity matching the combined niche carriers.

The shakeup in the ocean shipping industry comes as Maersk pursues a strategy positioning the company as an end-to-end supply chain provider. The company has acquired a number of logistics firms over the years in areas including fulfillment and trucking.

Excess capacity could cause a new price war among container lines

With a large number of newly delivered large container ships starting this year, if consumption does not keep pace with the growth of supply, container shipping companies could revert to a price war like pre-pandemic.

The chairman of Evergreen, Chang Yen-i, warned that with a large number of newbuild mega-box ships starting to be delivered this year if consumer demand does not keep pace with the growth of capacity, container shipping lines could return to the price war on shipping freight rates as before the pandemic. He made the statement at the National Association of China Shipowner's Chinese New Year celebration on Wednesday.

Evergreen itself has 49 ships with 463,442 TEUs under construction, but MSC, the market leader, has the largest order book, with 133 ships on 1.8 million TEUs being built, followed by Cosco (884,272 TEU) and CMA CGM (816,476 TEU).

Mr. Chang told the Taiwanese Shipowners Association: "After two years of amazing profits, the liner industry now faces three challenges. The first is the slowdown of international trade and the global economy; the second is the fall in container freight rates; and the third is the big number of new ships being built."

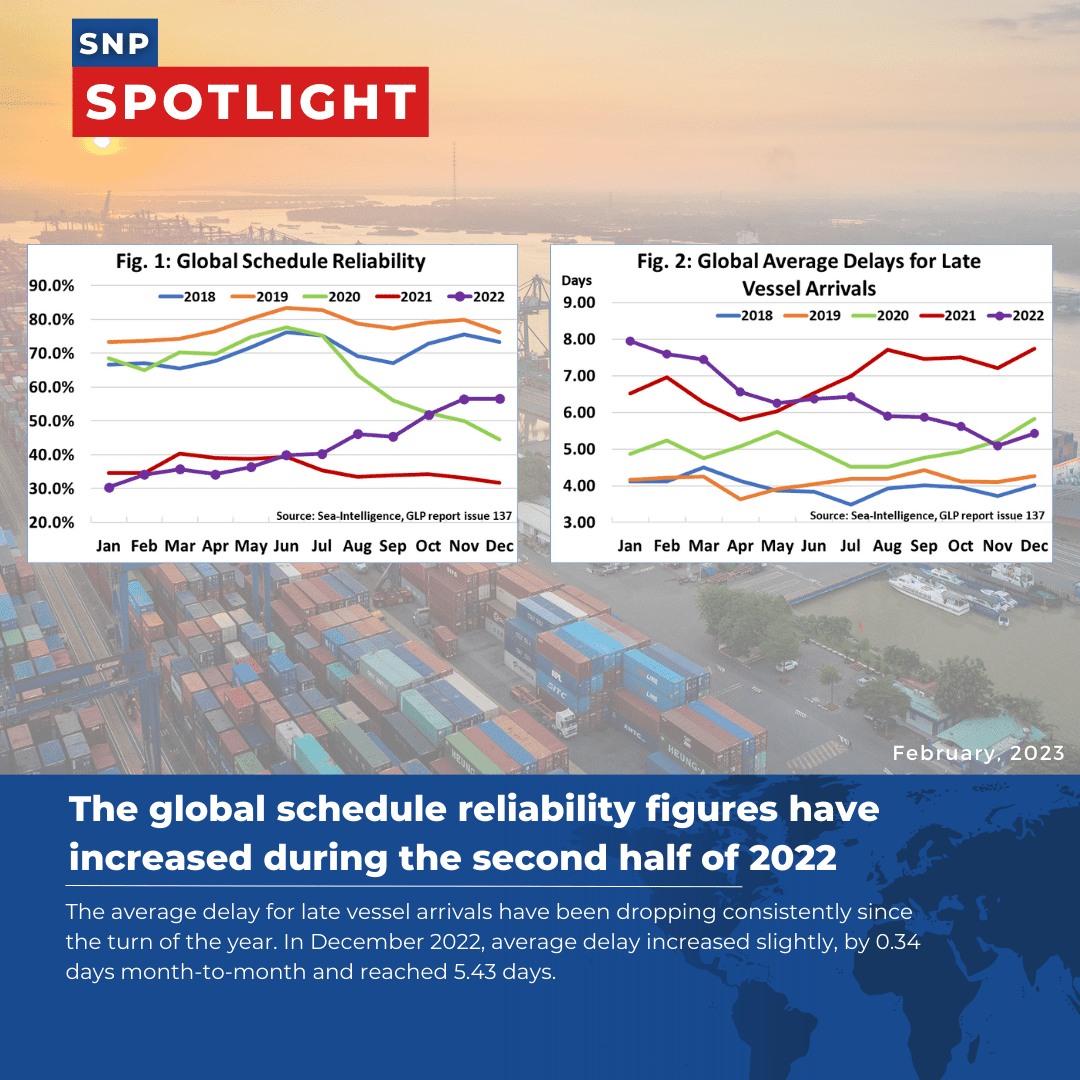

Box schedule reliability boosted by quarter in 2022

The global schedule reliability figures have increased during the second half of 2022, according to the maritime data analysis company Sea-Intelligence’s latest monthly report.

The rapid increase in schedule reliability experienced in the second half of the year has somewhat abated, according to the CEO of Sea-Intelligence, Alan Murphy.

The month-to-month increase in December was a mere 0.1 percent, taking the total figure to 56.6 percent.

On a year-to-year level, however, schedule reliability was up by 24.8 percent.

The average delay for late vessel arrivals has been dropping consistently since the turn of the year.

In December 2022, the average delay increased slightly, by 0.34 days month-to-month, and reached 5.43 days.

MSC was the most reliable top 14 carrier in December with 63.3 percent, followed by Maersk with 60.1 percent.

The schedule reliability of the next 10 carriers ranges from 50 percent to 60 percent.

Only Yang Ming and ZIM recorded schedule reliability of under 50 percent, at 47.7 percent and 47.2 percent, respectively.

Some 10 of the top 14 carriers recorded a month-to-month improvement in schedule reliability in December 2022.

MSC recorded no change while three carriers recorded a decline.

Yang Ming recorded the largest increase of 5.3 percent, while ZIM recorded the largest month-to-month decline of 6.1 percent.

All carriers, nonetheless, recorded double-digit, year-on-year improvements.

Ocean carriers 'boxed in' by 5m teu surplus equipment mountain

The return to ‘supply chain normalization’ has led to the container liner industry being hobbled by an estimated surplus of 5m teu of boxes, piled high on storage quays and in depots around the world.

Weak consumer demand and consequent easing of supply chain congestion have resulted in an expensive post-boom hangover for ocean carriers, as their equipment storage costs soar at the same time as their freight revenues plummet.

According to Drewry’s latest Container Equipment Forecaster report, the global container equipment fleet grew 2% last year, to 50.9m teu, but the consultant expects a contraction of 3% this year.

It says operators will urgently seek to off-hire as many leased containers as possible while retiring as much of their elderly own equipment as they can.

Drewry’s senior analyst for container equipment, John Fossey, said he expected “many thousands” of leased boxes to be returned to leasing companies this year and that, in combination with sales to secondary markets for storage and other uses, a “large part” of the 5m teu overhang will have been removed by the year-end.

Indeed, the world’s largest container lessor, Triton, with a fleet of 7.1m teu, reported an “increase in drop-offs” in the third quarter of last year after “a muted peak season”, and that no doubt would have accelerated in Q4 and in the first quarter of this year.

The second-biggest container equipment lessor, Textainer, also reported “demand decreased significantly” in Q3.

Nevertheless, the leasing companies successfully locked carriers into long-term contracts and extensions of agreements during the equipment crunch periods of 2021 and first half of 2022, so the lines may not be able to return all their surplus equipment without incurring substantial penalties.

However, carriers could decide to pay one-off early-return penalties rather than incur continuing storage charges for the equipment they have no bookings for.

The cash-rich carriers began to move away from equipment hire last year, with the lessors’ share of the global container fleet slipping from a controlling 51.2% in 2021 to 49.4%.

However, Drewry expects their share to start to recover as ocean carriers move back towards reducing their capex spending as purse strings tighten.

Unsurprisingly, container equipment manufacturing has almost ground to a halt, with Drewry saying this year could be “one of the worst on record”, estimating less than 700,000 teu will be produced. This compares with 3.77m teu manufactured last year, which itself was a huge 47% down on 2021’s record output.

Mr Fossey said following the lunar new year holiday, some Chinese container manufacturers may not resume production until March, at the earliest. In fact, The Loadstar has heard that a few manufacturing sites in China have not restarted production since the Golden Week holiday in October.

Meanwhile, the equipment surplus has seen the cost of a new standard 40ft high-cube container made in China plummet from about $6,500 at the peak of demand, to less than $3,000.

And second-hand box prices have also slumped, good quality used 20ft containers for storage purposes are now widely available in North Europe for $1,000 to $1,500.