Saigon Newport Corporation is the most reputable logistics company in the port operation group

01/12/2022

On November 30, 2022, Vietnam Repor tofficially announced the Top 10 prestigious Logistics companies in 2022.

Top 10 prestigious Logistics companies in 2022 are built on scientific and objective principles. Companies are evaluated and ranked based on three main criteria: (1) Financial capacity shown in the latest year's financial statements; (2) Media reputation is assessed by Media Coding method - encoding articles about the company on influential media channels; (3) Survey of research subjects and stakeholders was carried out in October-November 2022.

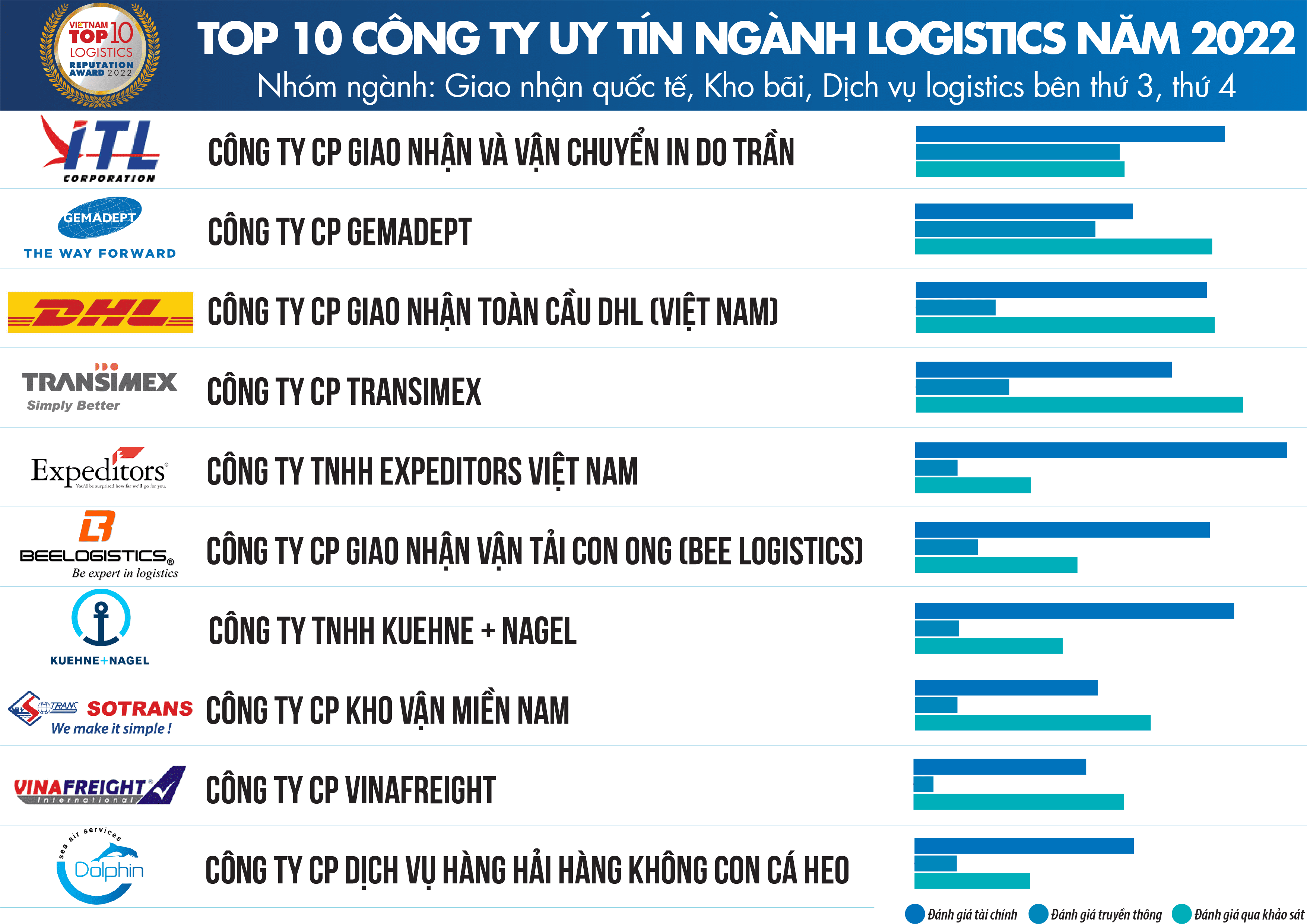

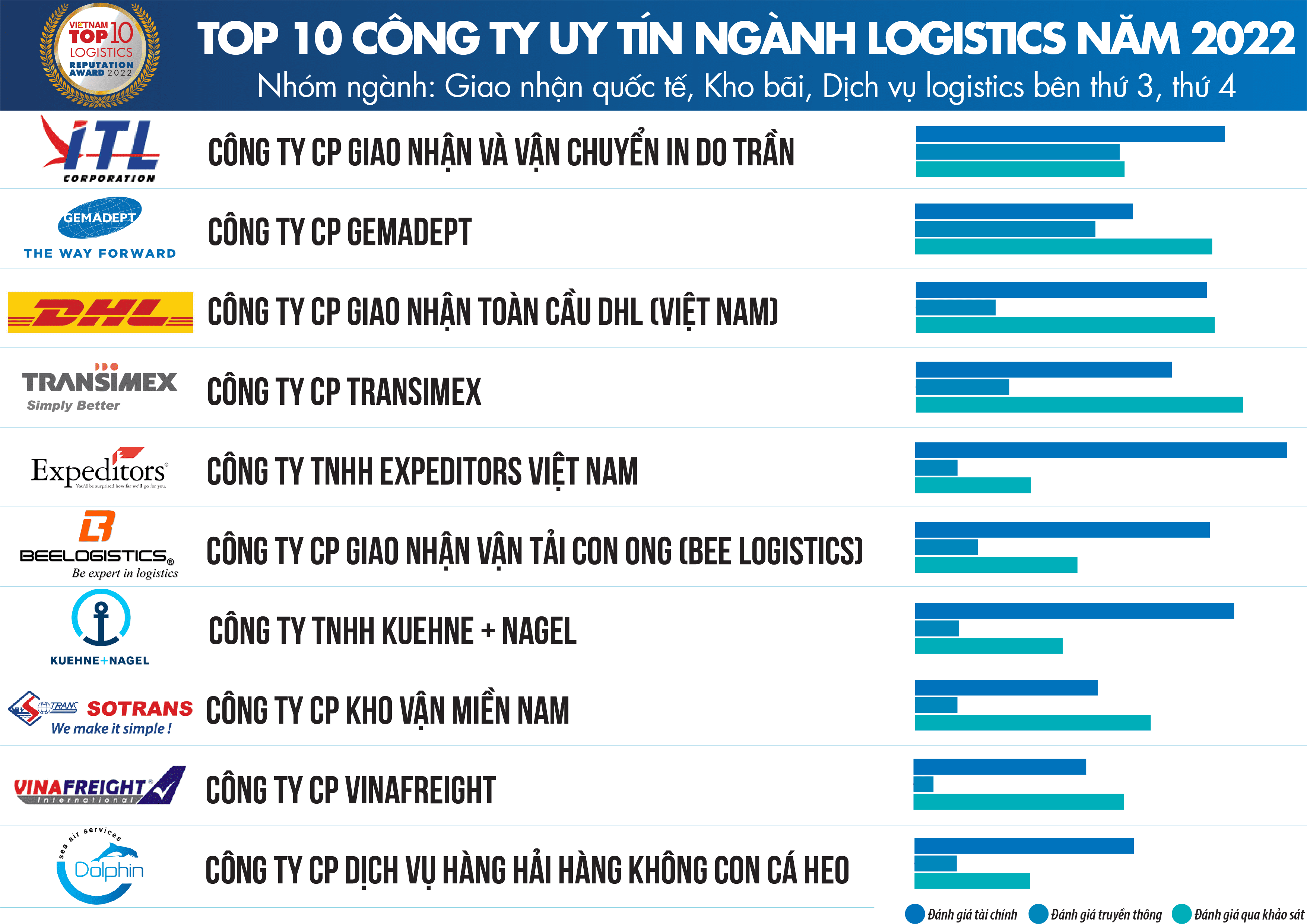

List 1: Top 10 prestigious Logistics companies in 2022 - International freight forwarding, Warehousing, 3rd party logistics services, 4th party

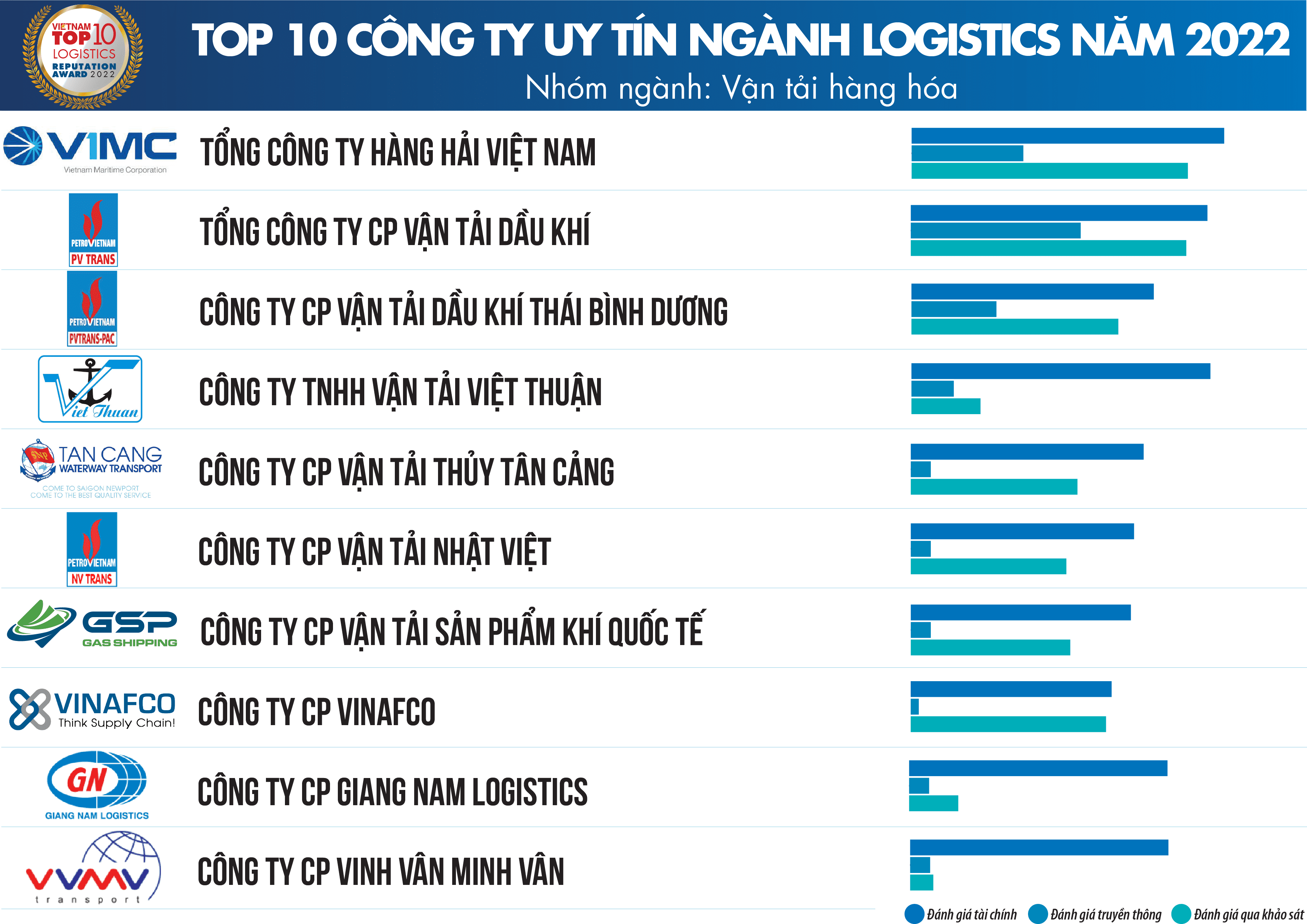

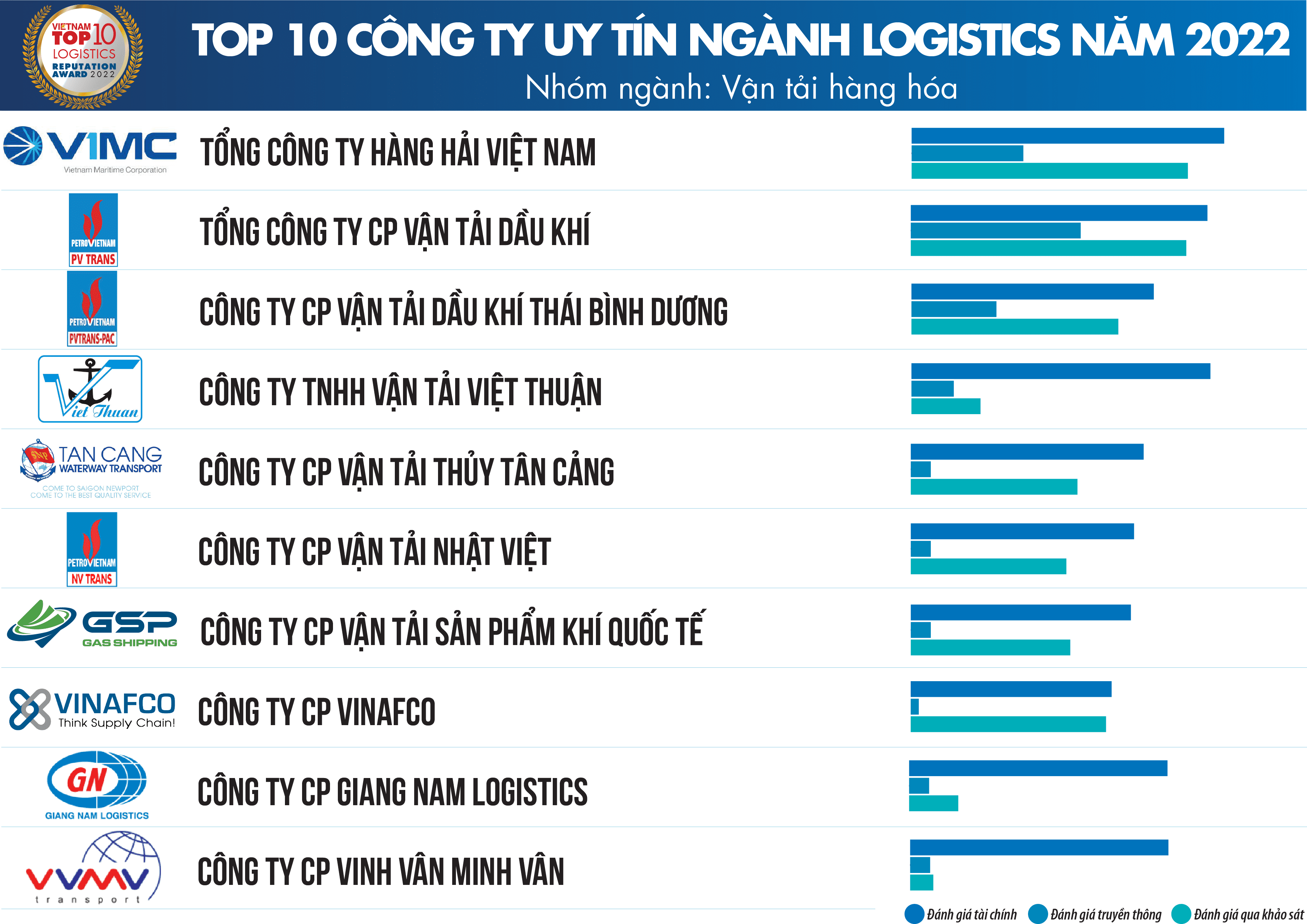

List 2: Top 10 prestigious Logistics companies in 2022 - Freight industry group

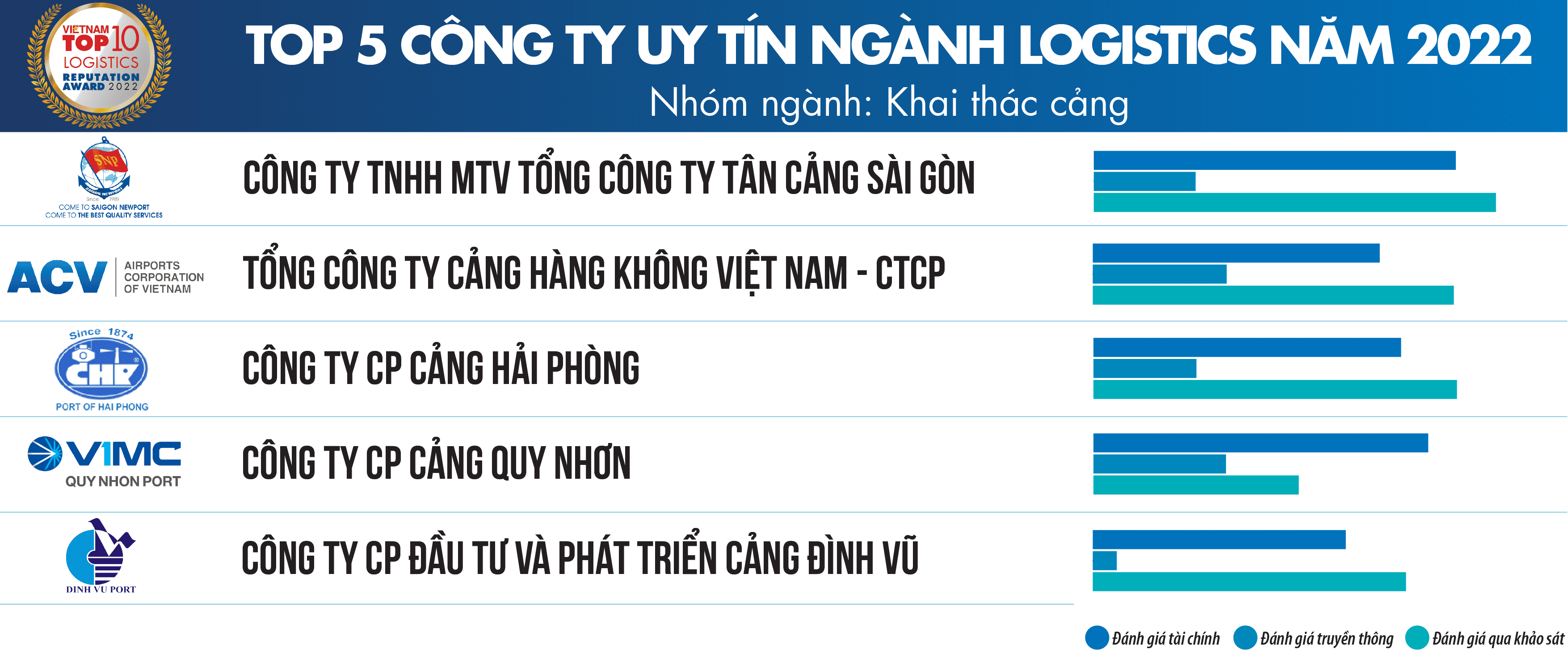

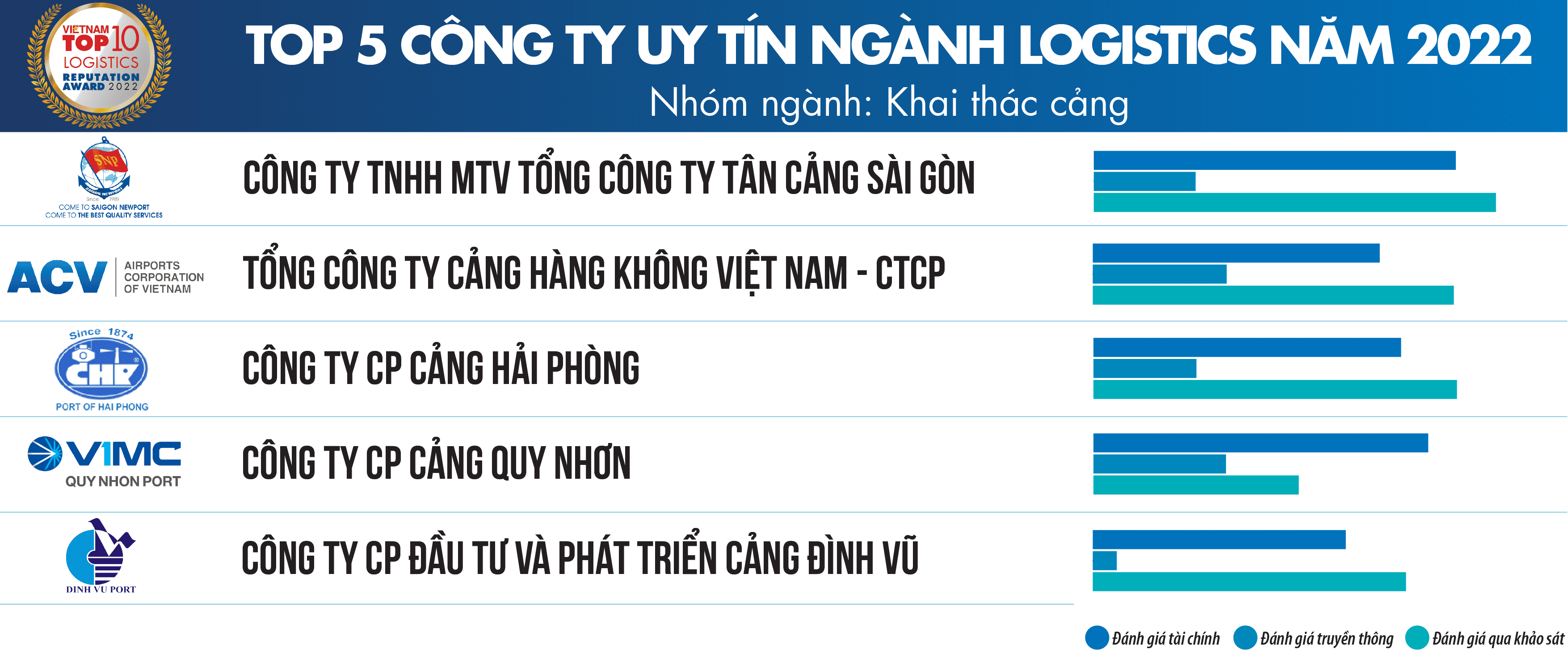

List 3: Top 5 prestigious Logistics companies in 2022 - Port operation group

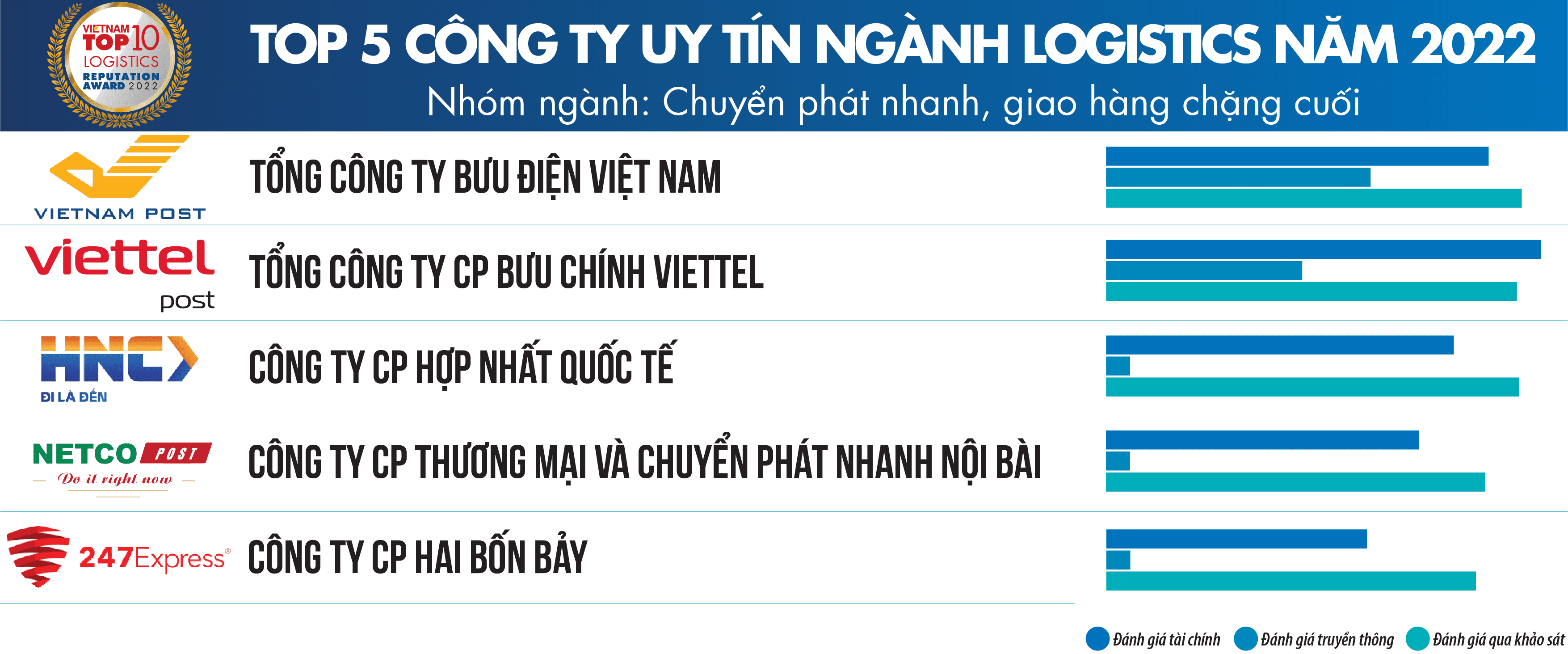

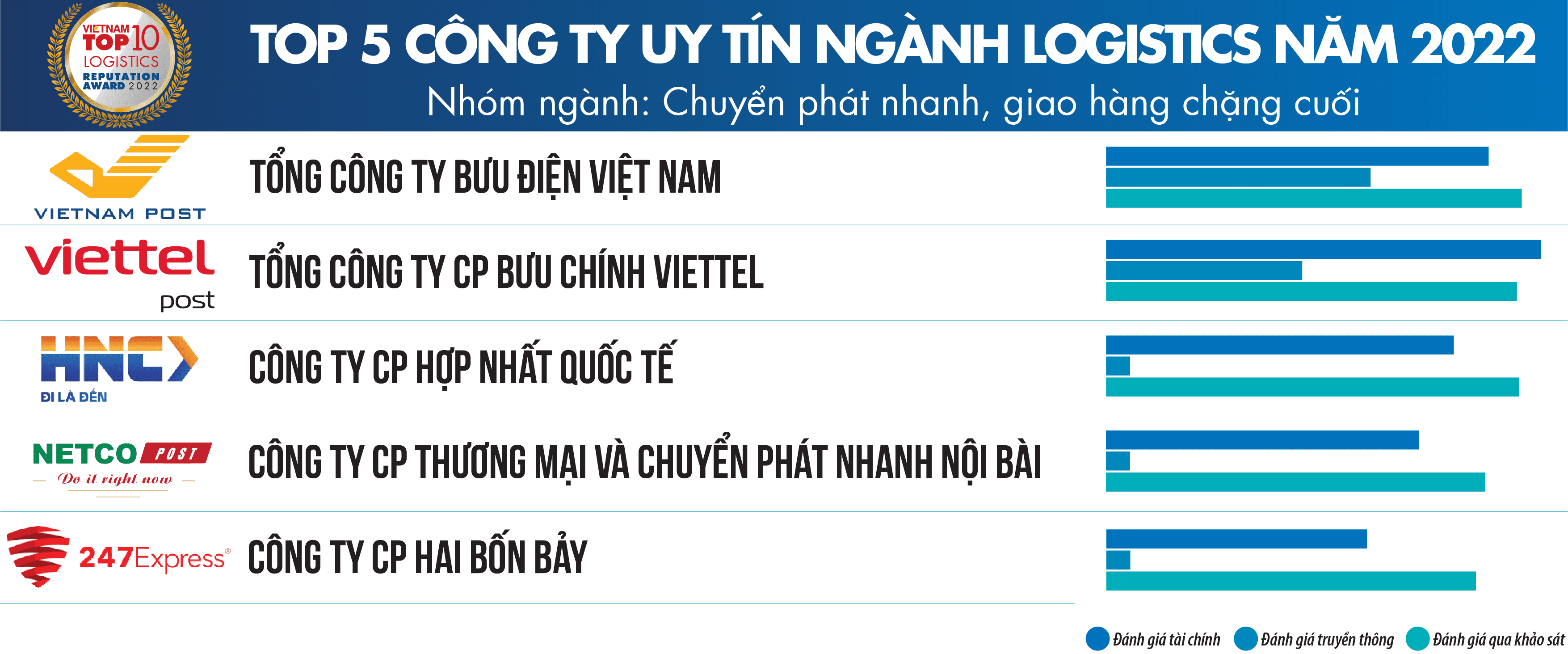

List 4: Top 5 prestigious Logistics companies in 2022 - Courier industry group, last mile delivery

List 2: Top 10 prestigious Logistics companies in 2022 - Freight industry group

List 3: Top 5 prestigious Logistics companies in 2022 - Port operation group

List 4: Top 5 prestigious Logistics companies in 2022 - Courier industry group, last mile delivery

In the context that the epidemic is under control, the global logistics market is on the verge of recovery, and port congestion is reduced after epidemic prevention measures are gradually removed. As one of the important links in the process of recovering import and export activities of the whole country, the logistics industry contributed significantly to this positive result: Total import and export turnover of goods in 11 months in 2022 is estimated to reach nearly 673.82 billion USD (exceeding the figure of 668.54 billion USD in the whole year of 2021). Generally in the first 11 months of 2022, the total volume of freight transport of our country is estimated at 1,832.9 million tons, up 24.6% over the same period in 2021; in which road transport accounts for 74.0%, inland waterways accounts for 20.3%, and sea transport accounts for only 5.4% but is still much higher than the proportion of rail transport (0. 3%) and aviation (0.01%).

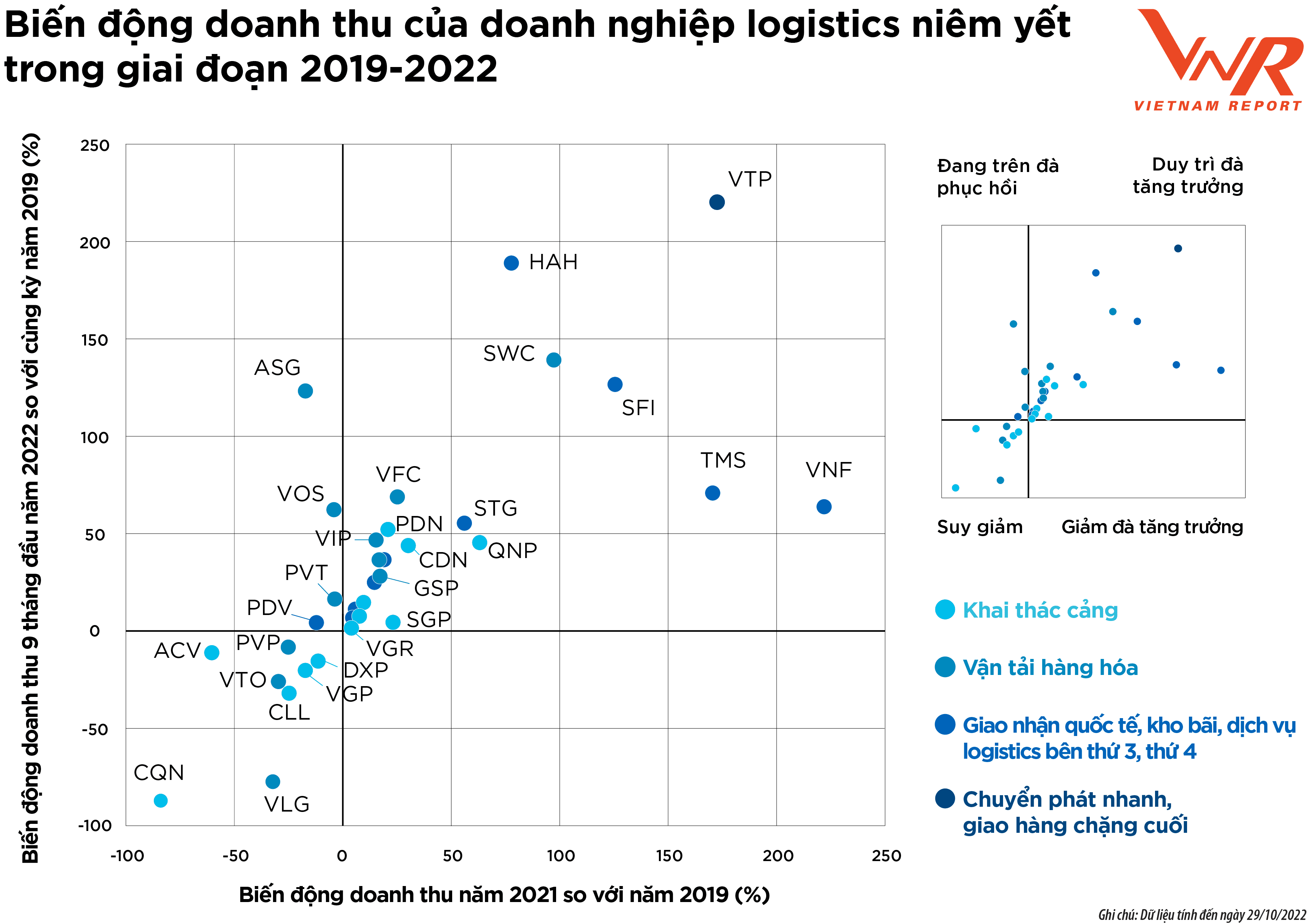

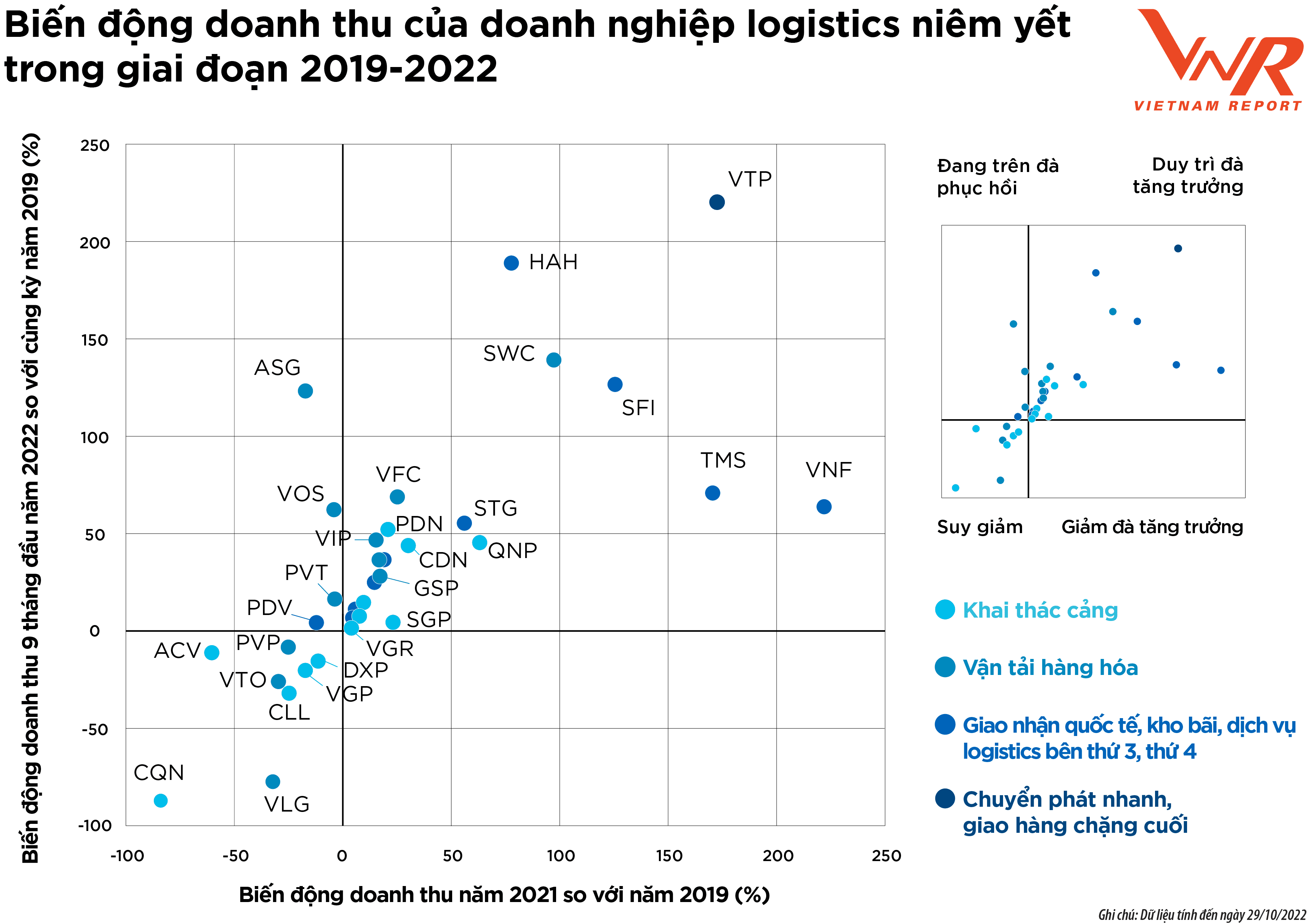

According to a recent study by Vietnam Report for businesses in the industry, 68.4% of businesses said that their revenue in the first 9 months of this year increased compared to the same period in 2021, of which 26, 3% recorded a significant increase. According to financial reports of 34 logistics enterprises listed on the stock exchange, 64.7% of enterprises still maintain revenue growth compared to before the pandemic (this figure was 35.3% at the time of the pandemic). points a year ago).

According to a recent study by Vietnam Report for businesses in the industry, 68.4% of businesses said that their revenue in the first 9 months of this year increased compared to the same period in 2021, of which 26, 3% recorded a significant increase. According to financial reports of 34 logistics enterprises listed on the stock exchange, 64.7% of enterprises still maintain revenue growth compared to before the pandemic (this figure was 35.3% at the time of the pandemic). points a year ago).

Figure 1: Revenue fluctuations of listed logistics enterprises in the period of 2019-2022

Besides that, there are still many challenges. The survey by Vietnam Report shows the top 5 biggest difficulties that logistics enterprises are facing, including fluctuations in energy prices and input materials; Competition among enterprises in the same industry; Supply chain risks; Political instability in the world; The demand for shopping and consumption decreases…

Energy price fluctuations are the most significant difference in the economic picture of the logistics industry this year, stemming from the Russia-Ukraine political conflict from March, leading to a massive shock to the supply and worsening the energy market. global fluctuations. Fuel costs account for a large proportion of the operating cost structure, posing a big problem for logistics enterprises in terms of price adjustment. Not only that, when fuel prices become a burden on businesses, it will cause many disadvantages in competition, typically increasing the gap in logistics costs of Vietnam compared to the world and regional averages. In ASEAN, Vietnam is now at 16.8% – higher than Singapore (8.5%), Malaysia (13%), and Thailand (15.5%).

In addition, risks from supply chain disruptions, political instability in the world, and reduced demand for shopping and consumption due to rising inflation in the polar regions of developed countries also create a synergistic effect on the operation of the logistics industry in the country. Analysis of financial statements of 34 logistics companies listed on the stock exchange also showed that, in the third quarter, an additional 8.8% of enterprises moved from the group "on the way to recovery" in the first 6 months of the year. 2022 to "decline" in the first 9 months of the year, reflecting the large elasticity of the industry's business results to domestic and international fluctuations.

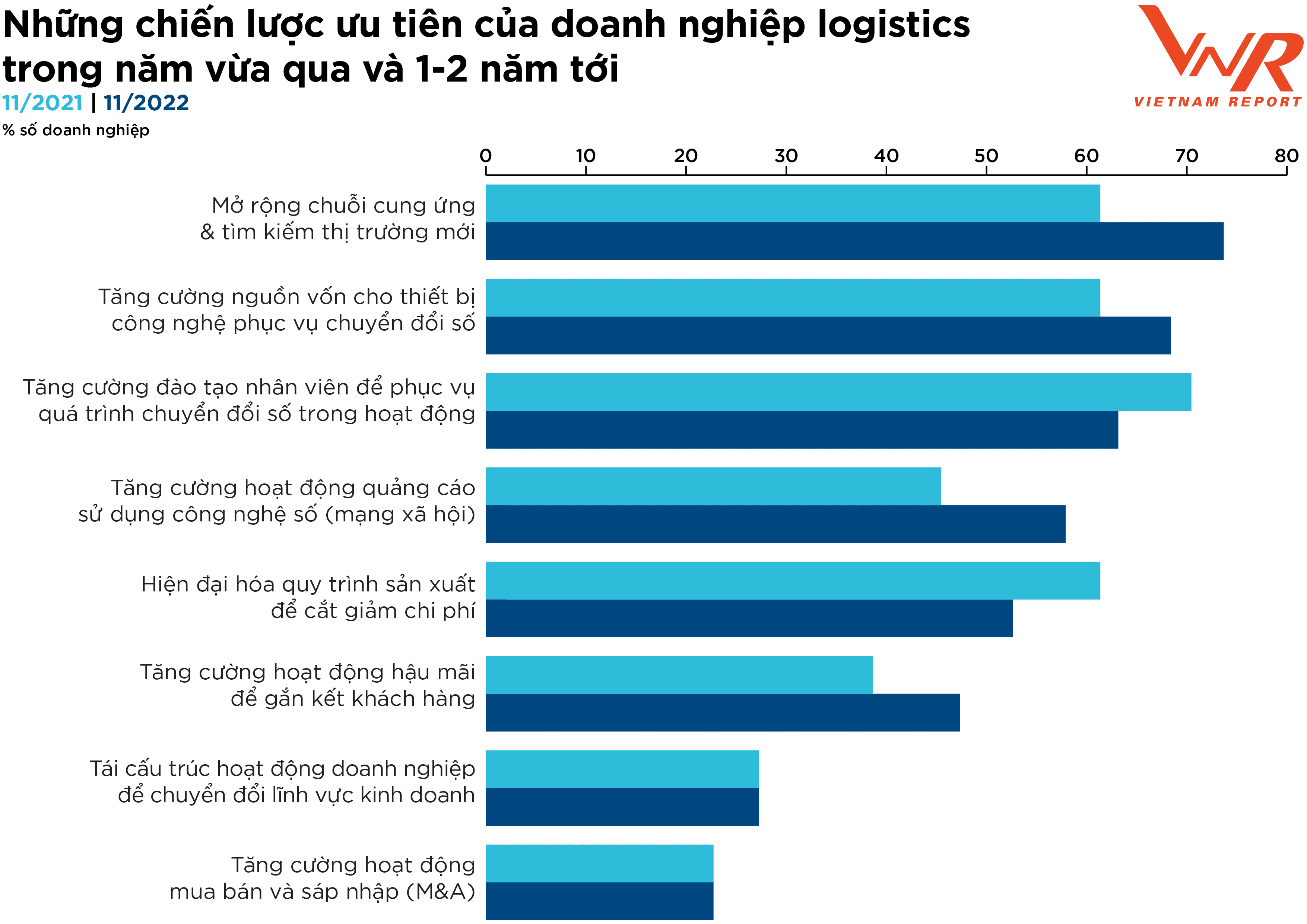

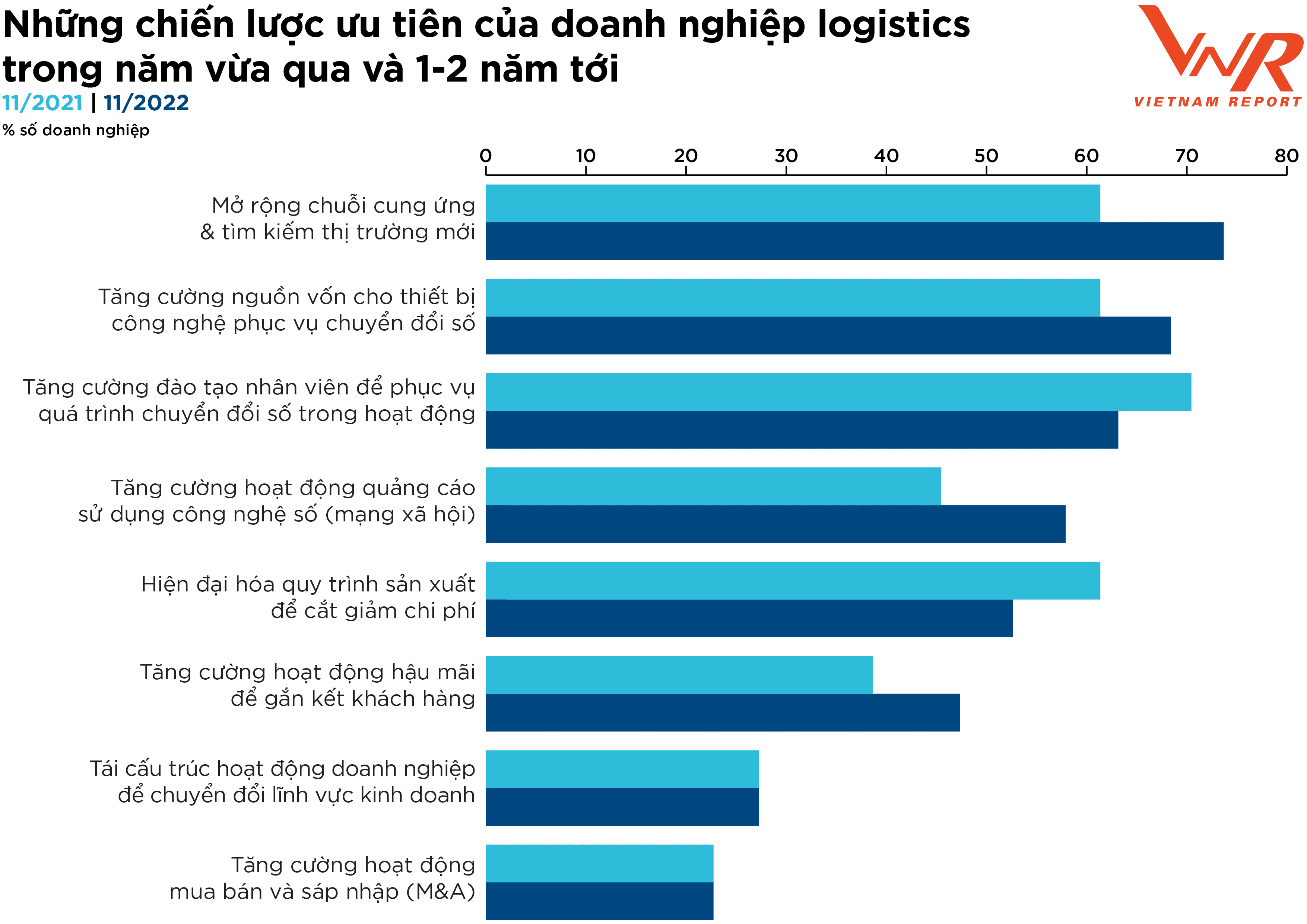

As the world is entering a new economic cycle, while technology improves the efficiency, flexibility, and speed of supply chains, social, political, and economic changes ( such as economic shocks, political tensions, or the recent COVID-19 pandemic) also pose a problem about the adaptation and development strategy of the business community in the industry. With the group of logistics enterprises participating in the survey of Vietnam Report, the priority strategies that businesses have implemented in the past year and set for the future are: Expanding the supply chain and finding new markets. ; Increase capital sources for technology equipment for digital transformation, and Strengthen staff training to serve the digital transformation process. These are also the top 3 priority strategies in the past two years.

Energy price fluctuations are the most significant difference in the economic picture of the logistics industry this year, stemming from the Russia-Ukraine political conflict from March, leading to a massive shock to the supply and worsening the energy market. global fluctuations. Fuel costs account for a large proportion of the operating cost structure, posing a big problem for logistics enterprises in terms of price adjustment. Not only that, when fuel prices become a burden on businesses, it will cause many disadvantages in competition, typically increasing the gap in logistics costs of Vietnam compared to the world and regional averages. In ASEAN, Vietnam is now at 16.8% – higher than Singapore (8.5%), Malaysia (13%), and Thailand (15.5%).

In addition, risks from supply chain disruptions, political instability in the world, and reduced demand for shopping and consumption due to rising inflation in the polar regions of developed countries also create a synergistic effect on the operation of the logistics industry in the country. Analysis of financial statements of 34 logistics companies listed on the stock exchange also showed that, in the third quarter, an additional 8.8% of enterprises moved from the group "on the way to recovery" in the first 6 months of the year. 2022 to "decline" in the first 9 months of the year, reflecting the large elasticity of the industry's business results to domestic and international fluctuations.

As the world is entering a new economic cycle, while technology improves the efficiency, flexibility, and speed of supply chains, social, political, and economic changes ( such as economic shocks, political tensions, or the recent COVID-19 pandemic) also pose a problem about the adaptation and development strategy of the business community in the industry. With the group of logistics enterprises participating in the survey of Vietnam Report, the priority strategies that businesses have implemented in the past year and set for the future are: Expanding the supply chain and finding new markets. ; Increase capital sources for technology equipment for digital transformation, and Strengthen staff training to serve the digital transformation process. These are also the top 3 priority strategies in the past two years.

Figure 2: Priority strategies of logistics enterprises in the past year and the next 1-2 years